Close

THE FUTURE OF TORONTO REAL ESTATE

Toronto, a city of the future

Toronto has a longstanding reputation as being a wide-ranging leader of sectors from technology and innovation to finance and healthcare. The city continues to invest in the infrastructure that all world-class cities need, particularly housing and transit. Such a civic framework constitutes an environment that people and businesses want to be a part of and experience. These are the facts, and they are not going unnoticed globally.

According to the Financial Times and their Foreign Direct Investment publication, Toronto moved into second place in the overall ranking (New York #1) as a city of the future. Our city showed resilient and persistent economy growth and development through the worst of the Covid-19 pandemic.

The 2021/22 study found Toronto ranks in the top 10 for human capital and lifestyle and moved from seventh to sixth in connectivity (measured through information, communications, and transport infrastructure). These are all massive indicators of growth and show our enormous capacity for development. We’ve said it many times in these pages, Toronto is on the fast track to becoming a true world-class city in all respects. It may have been overlooked or undervalued in the past when considering top global cities, but soon it will match the reputation of other urban powerhouses of economic stability (think of Miami, New York, London, Tokyo).

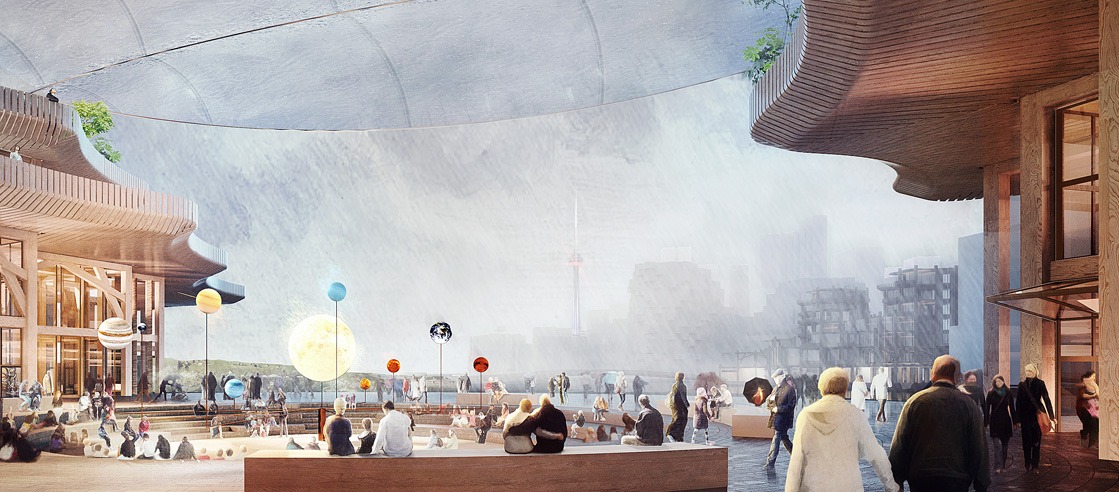

How Toronto's skyline could look in 2030

To better examine Toronto’s future, let’s start with a rewind all the way back to the turn of the millennium. Around this time, there were many optimistic predictions for property values and what was coming in the new century. “The real estate market will pick up during the second decade of the new century" was a common statement; but Toronto was very young and burgeoning at that time. It had been smooth sailing economically for a while at that point. But what about when difficulty arose?

2007

The strength of the Canadian housing market has befuddled economists, who figure it should have peaked by now. As a result, analysts have been scrambling to revise their figures. Last week, the Canada Mortgage and Housing Corporation revised its forecast for the third time. Initially predicting a decline, they now say 2007 sales should hit a new record.”

This type of comment sounds familiar today, 15 years later, as prognosticators and experts alike try their best to sell content and get subscribers. The subprime situation caused massive stock market turmoil, with banks and hedge funds suffering major losses. In the middle of all this, in 2007 Ontario’s real estate market grew by more than 8%.

During 2007 the average price of a home was projected to set new records over the following two years. The Canadian Real Estate Association (CREA) changed their prediction, to a 10.4 per cent increase for 2007.

Interestingly, also in 2007, our friend and long-time economist Benjamin Tal predicted that the average price of a home nationally would double by 2026. According to the CREA, at that point, the average price in Toronto was around $379,000. Tal was onto something there, however, home prices actually doubled by 2019, and are most likely going to redouble in the near future. Perhaps three doublings by 2026 was the correct forecast in 2007.

When reporting on 2007, the CREA claimed that “this year (2007-08) will be the peak and by next year, sales will start to trend down about 2 per cent below this year.”

2010 through 2012

From a CBC News report in 2010:

"Economists agree that double-digit increases in housing prices in the absence of significant income gains are unsustainable in the long run."

So far, the long run has been greater than 12 years and the market has seen almost exclusively 10+ percentage point annual increases over that span.

In 2012, there was a lot of talk of a real estate bubble in Toronto. Many felt that the housing boom had gone on far too long and that a correction was in store for Toronto real estate prices and Canada as a whole. It all sounds a bit familiar!

2020 – now

If we look at what the talk was when the Covid-19 pandemic first took hold of our society we can see a more recent and data-driven analysis of the market.

From CTV News, April 2020:

“The best-case scenario – which hinges on stay-at-home restrictions easing in the coming weeks – would see home prices grow a modest 1 per cent by the end of the year. The aggregate value of a Canadian home would come to $653,800. If heavy restrictions are still in place through late summer, home prices are expected to decrease by 3 per cent across Canada by the end of 2020, bringing the aggregate value to $627,900.”

Home prices across Canada ended 2021 averaging over $811,000.

In the media, the words ‘bubble’ and ‘crash’ are used too often and what they actually mean is a market shift downward. But when you look at the housing market over the past 25 years, there are two significant times when prices dropped suddenly, and they had nothing to do with the market. The market was reacting to governmental forces: the stress test and the fair housing plan. Also, when these dips were occurring, the condo market increased while inventory expanded; the declines were all in the detached market.

In the recent past, we can see that prices started to dive (in the detached market) at the exact time that the fair housing plan was announced. The market then regressed further as the mortgage stress test was announced and implemented. There is nothing natural about a market change following new government legislation targeted at the housing market.

The pandemic tore at the fabric of society and wreaked untold havoc here in Canada and globally. It has caused many changes to industry and commerce. Nobody would have projected the increases in real estate values to occur when the pandemic was beginning. But that’s the point, isn’t it? The overarching trend is that when issues in the economy arise, we assume a narrative of downfall; a narrative which says that because of immediate circumstance the market cannot keep up what it is doing, taking for granted that it must decline. The counterpart to this narrative of assured destruction is the story that the city is actually, in reality representing the fundamental economic lesson of supply and demand.

Present Day

Toronto, 2022

In the two years preceding the pandemic, the GTA built enough housing to accommodate 155,385 additional residents. However, in the same period of time, we saw net immigration to the GTA exceed 250,000 new residents.

The perennial topic of the day in Toronto is what we have dubbed a ‘housing crisis.’ Indeed, we are in one, and have been for some time. It’s a supply crisis and a demand crisis, not one or the other but both. We’ll get to this later.

At the time of writing, the Toronto condo market is holding strong amidst a torrent of bad news, rate hikes, and other forces. The average price of a Toronto condo is holding strong, up 4% over last year. Given the activity in the market is down across the board due to rate hikes, we can attribute this gain to investors, as Toronto rentals continue to balance the Toronto condo market.

Toronto is seeing record low condo availability and high and increasing rental prices. Rentals are going to continue to increase in demand in the short term. The Toronto market will not be able to add enough inventory to make a dent in the demand.

Now we can talk about the two forces that are causing the housing crisis we are seeing. Markets, if left untouched, are time machines. The market tells you what the world will look like 12-18 months from now. For example, most financial markets bottomed in April 2020 as we were in the midst of the worst part of COVID. The time machine – the market – saw things getting better. As a consumer or investor, when you are "ready & comfortable" the market will have already appreciated.

Simply put: there isn’t enough housing in the G.T.A. to accommodate everyone that wants it. Supply and demand have lost alignment. And staying with our theme of ‘look to the future,’ we may expect future supply to be insufficient just as it is now.

We’ve heard all the noise in the news about trying to solve the shortage and build more houses (including new policies and governmental action). But as all good econ students know, the government cannot provide the answer. In fact, you can argue that less government regulation would improve the supply side of the issue quicker.

Expanding on the concept, if we need somewhere around 45,000 homes or more (to supply the approximately 250,000 new people), why are only 35,000 built? Right now, it’s because it’s too expensive and takes too long to meet the full quota. In Toronto the condo approval process is arduous and lengthy. Two to five years is a common timeframe for a developer to go from buying land to starting construction. Plus, when you consider that the city has raised administrative charges steadily, I don’t think developers are lining up to lose money and time, just to get housing into the market.

Strictly looking at the demand side, we’ve touched on it but the G.T.A and Toronto see huge amounts of immigration every year (from out of country and out of province). Looking at immigration forecasts and models is perhaps the best way to predict future population growth and levels.

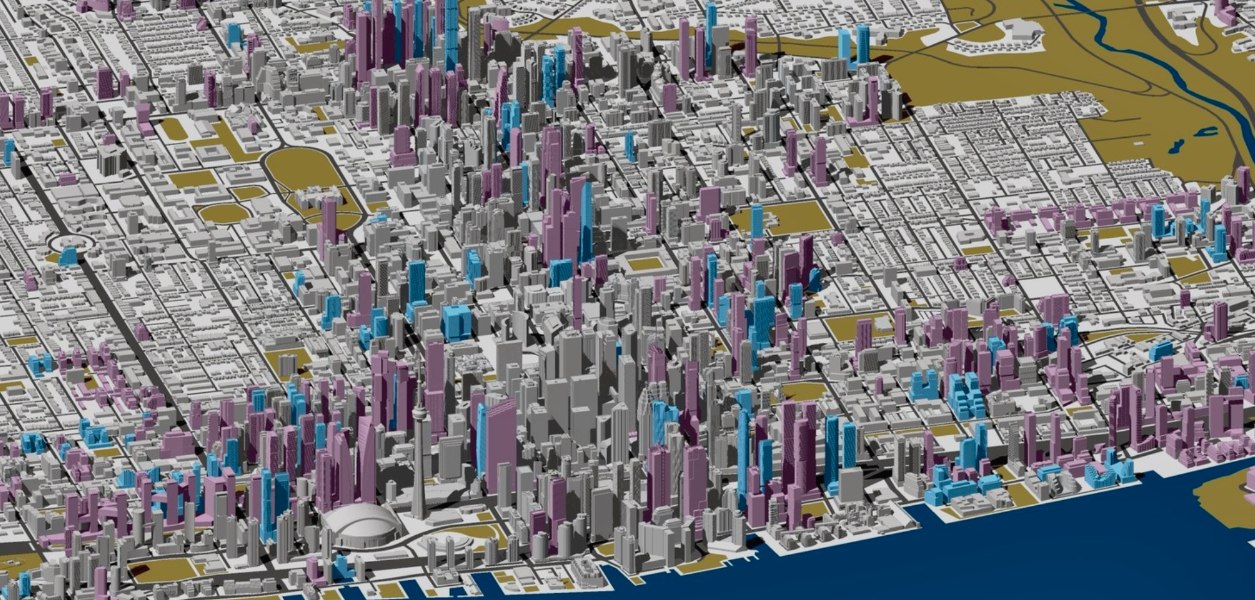

Image via Future Model Toronto:

There are many factors that go into market balance. However, the two biggest levers, one from each side of the equation, are new home completions from the supply side and immigration on the demand side. It boils down to the fact that there are not enough homes being built to house the amount of people who come year over year.

Until the balance changes, we will not see prices decline in the long-term, in the next decades.

An important note about real estate investment and it’s impact, or role, in the supply and demand equation:

As we know, in general, markets are better off left to manage themselves. Most political intervention has no effect or a negative effect on the issue it’s aiming to solve. For example, the mortgage stress test was introduced to cool the housing market. The intention was to help first-time buyers, but it did the opposite. It made things more difficult for first-time buyers to qualify for a mortgage with no existing home equity. It also increased the demand in the condo market, which is where most first-time buyers are positioned.

Not only is Toronto real estate one of the media’s favourite topics to generate clicks, but it’s also very buzz-worthy for politicians – as we saw in the elections in October. Everyone has some bright idea for what will fix for the market.

You read about how people in general want the government to step in and solve the ‘problem’ of price appreciation in Toronto and the G.T.A. And, as we know, appreciation is inevitable and policies have been enacted recently and they failed, twice.

The fair housing plan that was created to slow rental rates by putting rent controls on landlords resulted in median condo rental rates increasing in Toronto by 25% in just two years.

In the current environment, to accommodate growth throughout Ontario and to address the housing supply shortage, the provincial government made an announcement that based on the recommendations of the Ontario Housing Affordability Task Force, they have set a target to build 1.5 million homes in Ontario by 2031 through an amendment of the Planning Act. This is encouraging news; however, the construction industry has a workforce shortage that is making it difficult to build and to keep up with the demand for homes during this time when there is a severe housing shortage.

If we don’t deliver the number of homes that are in demand, it is not because the developers aren’t ready to do so, it’s because they are faced with practically insurmountable barriers.

The condo market continues to diversify itself

Let’s look specifically into the future and view the world from a condo lens as a preview of demand into the future. Recent data shows that condominium market share, as a proportion of total sales in the Greater Toronto Area is 36.3%, up from 34.5% in 2021.

In addition to a higher share of the housing market, condo values in Toronto are trending upwards, from $688,137 one year ago to $796,457 currently. In addition to price appreciation continuing for condos, rental activity is very strong.

Although the GTA’s housing market is certainly in a turbulent period, the forecasts for the region’s long-term condo market are strong and steady in the face of favourable population growth forecasts and limited inventory available for sale and lease. As always, we come back to the fundamentals of demand and supply.

According to recent data from Statistics Canada, the number of people living in Canada rose by 0.7%, or 284,982, to 38.9 million in the second quarter of 2022, signifying the highest rate of quarterly growth since 1957 and representing an increase of about 3,100 people per day. Looking at the lay of the land, we have to ask whether development can match the pace.

The projections by Statistics Canada indicate that in a medium-growth scenario, Ontario’s population will grow from 14.8 million to approximately 19 million by 2043 and could even surpass 21 million in higher growth scenarios. An increase of six million from the current population.

Drag the centre bar to compare Toronto circa 1990 and today

The recent population projections for Ontario further indicate that its construction industry will need significant increase in its workforce to deliver on both the housing and infrastructure needs of a much larger population, especially if immigration policy stays the same or becomes more liberal.

To address labour shortages, in 2023 the federal government will start being more strategic in how they choose residents by targeting those in specific occupations and with certain skills.

The big picture is that Canada has flung the door open and is welcoming more people to the party. Due to those immigration policies, Canada will continue to increase its immigration levels in the future. This is expected and natural, as immigration remains critical to supporting a healthy and growing economy.

Secure Your Investments with TCS' full-time licensed and dedicated brokers

Lately we have been receiving a large number of inquiries about leasing, assigning and selling units through our brokerage division. Please note that we have a team of licensed, award winning, and dedicated full time real estate brokers on staff that are specifically retained by TCS to manage our ownership group's own properties as well as all those of our clients. This value-add service is part of our promise to provide full turn-key services so that all your investment needs are met under a one-stop-shop platform.

By working with TCS’ broker team members, you will be able to better secure your investments as we always aim to price-protect our investments so that we all win as opposed to outside brokers, who may have one or two listings and most likely won’t have the required relationships with the developer, the on-site property management team and the security service providers. A certain high-level expertise and building/project knowledge is needed to manage this intricate process and TCS has that at all its sites.

Don’t trust your valuable real estate investment portfolio to outside firms/brokers who aren’t in it for the long run and won't protect and serve your needs.

CREATING REAL ESTATE MILLIONAIRES

ONE CLIENT AT A TIME

The Condo Store Realty Inc. (Brokerage)

171 East Liberty Street, Suite 101

Toronto, ON M6K 3P6 CANADA

Tel: 1.416.533.5888

Email: office@condostorecanada.com

CREATING REAL ESTATE MILLIONAIRES

ONE CLIENT AT A TIME

The Condo Store Realty Inc. (Brokerage)

171 East Liberty Street, Suite 101

Toronto, ON M6K 3P6 CANADA

Tel: 1.416.533.5888

Email: office@condostorecanada.com