Close

Illustration by Sebastien Thibault

South Florida real estate has long been a haven for foreign investment, but for years, that meant South American money more than anything else.

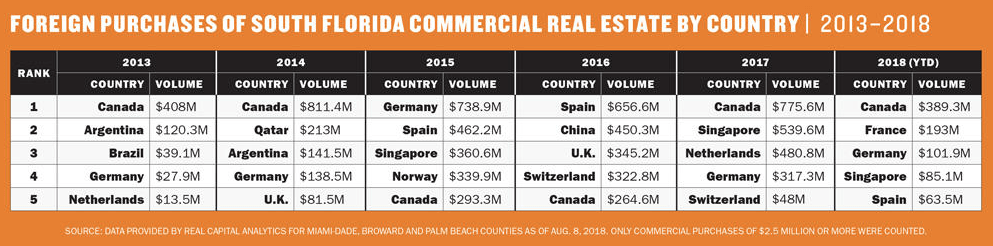

Today, the region’s reputation as a mature real estate market is growing larger on the global stage, experts say, and South Florida is becoming more of an attractive destination for large institutional foreign investors from around the world. European and Canadian investors now account for a much bigger share of foreign investment in the residential and commercial markets in the tri-county region, according to a report by the National Association of Realtors (NAR) and data provided by Real Capital Analytics (RCA). And Asian countries remain engaged in the area. Singapore has been among the top five investors three times in the past three and a half years, and China accounted for the second largest source of foreign investment in 2016.

“There is capital that is coming out of markets like the Middle East, like Europe, increasingly they are viewing South Florida as a place to invest comparable to L.A. and New York, but with somewhat better pricing power,” said Ken Krasnow, Colliers’ executive managing director for the South Florida region.

Canada goes commercial

The largest foreign investor in the commercial space over the past two years has been Canada, which invested $389.3 million this year as of August 2018 and $775.6 million in 2017, according to the data.

Long attracted to South Florida residential properties in order to escape the dreary winters of the north, Canadians are showing interest once again in expanding into local commercial real estate.

“The residential and commercial investments are complementary, and you gravitate toward what you know,” said Jaime Sturgis, the CEO and founder of Native Realty Co., which specializes in leasing and investment sales in emerging markets throughout the tri-county area.

Glenn Cooper, president of the Florida-Canada Chamber of Commerce, added that Canadian investors are looking for bargains. “They are looking at buying a large number of units … they might even send a Canadian real estate fund down here to do rentals,” Cooper said.

Cooper said part of this growth could also be due to the emergence of Canadian banks in South Florida, including Natbank and Desjardins Bank, which now has four branches in South Florida. Having their local banks here has made Canadians more comfortable with investing in real estate in the area, Cooper said.

Another factor in recent developments in the Canadian- South Florida real estate equation could be the emergence of new Canadian companies in the area. Bombardier opened a Learjet facility at the Fort Lauderdale-Hollywood Airport, and Canadian pharmaceutical giant Apotex is planning to move its U.S. headquarters to Miramar next year. As more Canadian companies expand in the region, some hope that the increased exposure to South Florida will increase their real estate investment in the area.

However, the uncertainty surrounding the North American Free Trade Agreement could cause some Canadians to hit the brakes. President Trump has warned that Canada will be left out of any new free trade agreement if a “fair deal” with the United States is not reached. This could have huge ramifications for Canadian companies that do business in the U.S. since it would mean they would have to pay more in taxes to transport goods across the border.

For now, though, the region is enjoying the uptick in Canadian and European investment, which is set against a backdrop of a broader increase in institutional investment everywhere.

According to the research firm Preqin, as of August 2018, the number of global institutional investors who put more than $1 billion into commercial real estate was up 13 percent from the same period in 2017. “The bigger trend is that pure institutional capital … is really the driving force on the commercial space,” Krasnow said.

Last year, the German investment fund Bayerische Versorgungskammer (BVK) paid $283 million for 1111 Lincoln Road and an adjacent property in South Beach, marking one of the biggest deals in Lincoln Road’s history. In total, Germans invested $317.3 million in commercial real estate in South Florida in 2017, according to the data.

Meanwhile, just five years ago, the second and third largest investors in South Florida commercial real estate were Argentina, at $120.3 million, and Brazil, at $39.1 million, according to data from RCA.

But in recent years, South American countries have dropped completely out of the top five when it comes to foreign commercial investment in South Florida, according to RCA data on commercial transactions of $2.5 million or more as of August 2018.

“Unless the money is already out of the country, [South American investors] are dealing with a dollar that is more expensive,” said Alan Lips, an attorney at the Miami-based law firm Gerson Preston.

Residential market

The same broader trends affecting foreign commercial real estate investment in South Florida are impacting the residential market. Currency devaluations have weakened the buying power for South American countries, brokers say, while there is more interest from Europe.

Although data from NAR shows that 46 percent of foreign residential investment in South Florida in 2017 still came from Latin America and the Caribbean, Canadian buyers made up 19 percent of non-U.S. buyers in South Florida’s residential market.

Real Capital Analytics

There’s more parity between the Canadian and U.S. dollar, which is appealing to Canadians; they may also be attracted to the local prices, which are looking better than those back home. U.S. home prices rose by 4 percent in the second quarter of 2017, according to NAR, while prices in Canada’s residential market rose by 11 percent over the same period.

Toronto, in particular, has some of the fastest rising real estate prices in the world. There, housing prices have risen 60 percent in the past five years, according to the Toronto Real Estate Board as reported by the Financial Post.

Real estate prices have skyrocketed in Canada’s biggest city in part because of an increase in Chinese investment there, which has helped to increase the average condo price to $972 per square foot in the downtown area, according to the Globe and Mail. Comparatively, luxury condos in downtown Miami have an asking price of $848 per square foot, according to Miami real estate consultancy Condo Vultures.

“Real estate is taking off in Toronto,” said the Florida-Canada Chamber of Commerce’s Cooper. “We are seeing a lot of Canadian hotel owners, investors and groups coming down here.”

Shahab Karmely, owner and CEO of KAR Properties, said that about 30 percent of the inquiries at his planned 2000 Ocean Condominium in Hallandale Beach have come from Canadian buyers. Many are very price sensitive, which is what draws them specifically to Broward County, he said.

Simon Mass, CEO of the Toronto-based brokerage the Condo Store, said that Karmely’s project has many features that are attractive to Canadian buyers, including the fact that the units will be fully finished.

“Canadians don’t want decorator-ready … they want to move in hassle-free and that’s going to be key for them to buy at preconstruction or under-construction sites,” Mass said.

Mass added that in the past six months, his firm has been approached by half a dozen South Florida developers “seeking to have their product marketed through our Toronto offices.”

Europeans have also taken a greater interest in South Florida’s residential real estate. European buyers made up 18 percent of all foreign residential real estate investment in the area last year, according to RCA.

Alicia Cervera Lamadrid, managing partner of Cervera Real Estate, said that about half of her foreign clients at Aston Martin Residences come from Europe. “For the first time, we are seeing an equal interest between South Americans and Europeans,” she added.

The French could also see an investment opportunity in South Florida housing prices, as those in Paris have soared in the past few years. In France’s capital city, housing prices have increased to more than 9,000 euros per square meter — which converts to about $900 per square foot — one of the highest rates ever in France’s history.

Henry Torres, founder of the Astor Companies, said that over the past year, he has seen an increase in French buyers at his planned 10-story Merrick Manor project in Coral Gables. “One of the things they like about Coral Gables is we have schools here that cater to the French,” Torres said, adding that the climate helps, too.

Ultimately, those watching the real estate market in South Florida say that the makeup of the foreign investors may shift, but the demand from elsewhere around the world will grow.

“People love to put money in America, and they want to put it in premier cities,” said Ed Easton, chairman of the Easton Group. “I do believe there is still a lot of money that would like to be here.”